Alpha-Klima is a climate risk platform that helps companies and financial institutions quantify the impact of climate change and make data-driven decisions with regulatory confidence.

Assess your exposure to physical climate risks using advanced data and modeling to support financial planning and compliance.

Alpha-Klima simplifies climate risk analysis and turns complex data into actionable financial insights.

We build on and contribute to OS-Climate open-source components—embracing transparent methods, peer-reviewed models, and a shared community roadmap. This ensures our solutions remain cutting-edge, interoperable, and auditable.

Climate risk assessment refers to the process of identifying, analyzing, and managing both physical and transition risks associated with climate change. These risks can significantly affect a company’s assets, supply chains, and overall financial performance. Physical risks include extreme weather events like floods or heatwaves, while transition risks arise from policy changes, market shifts, and technological innovations. Conducting climate risk assessments enables businesses to anticipate disruptions, comply with regulations, and strengthen long-term resilience and sustainability.

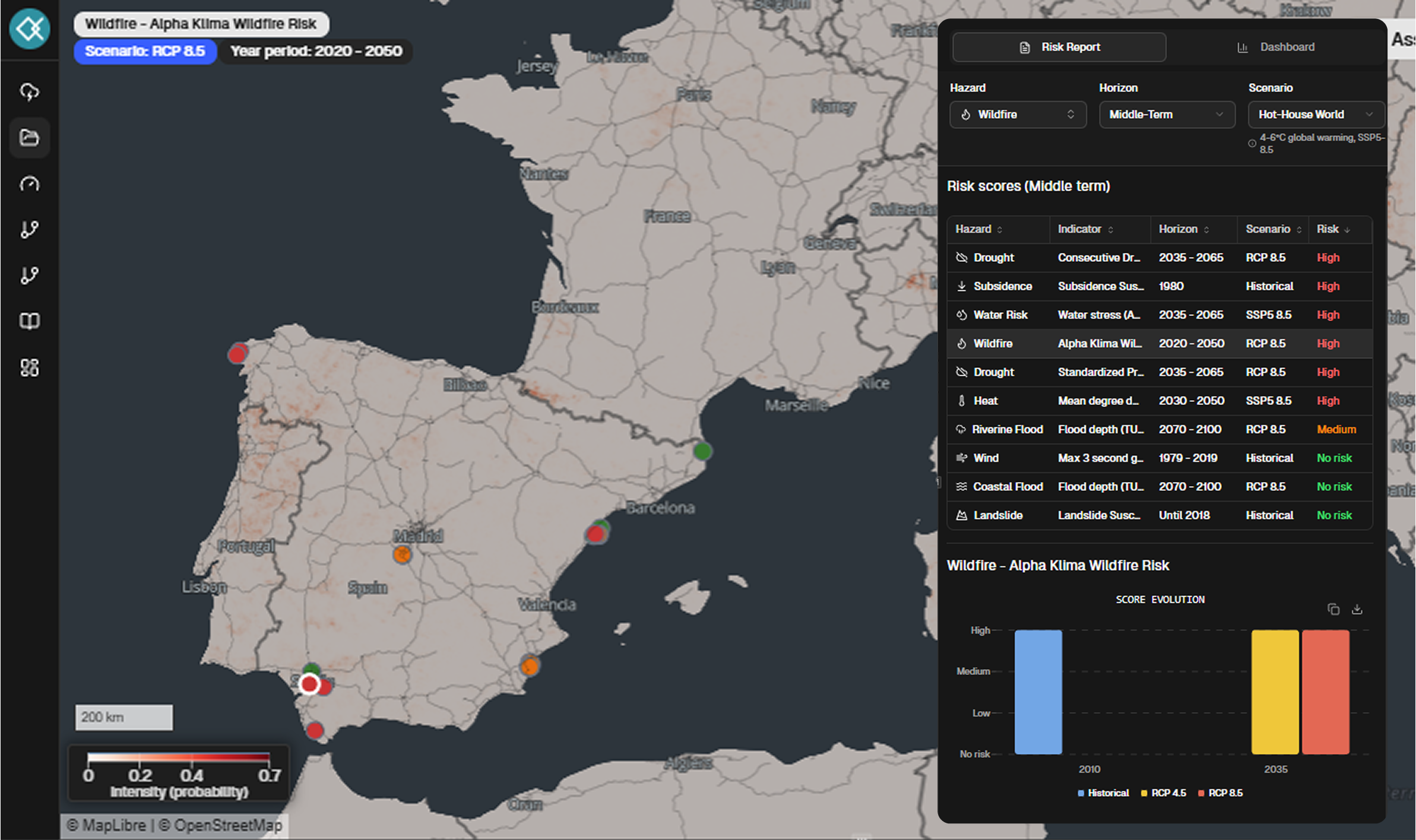

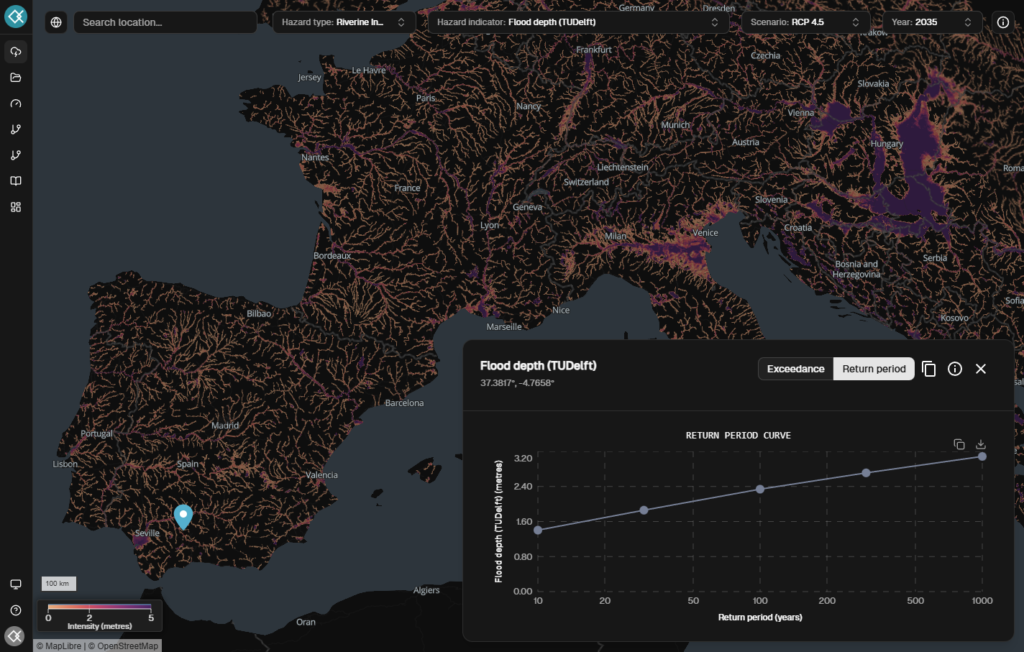

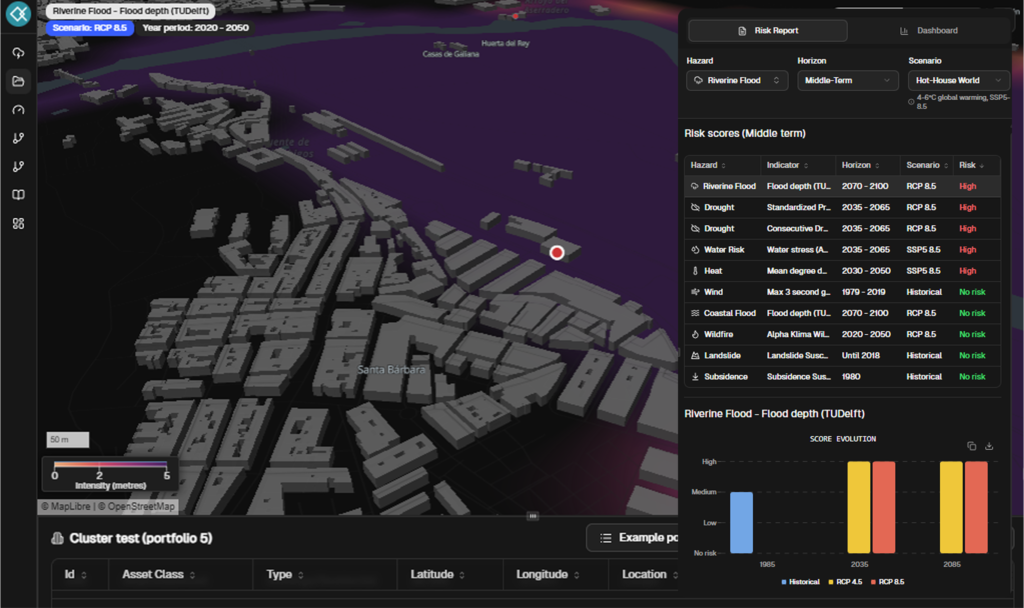

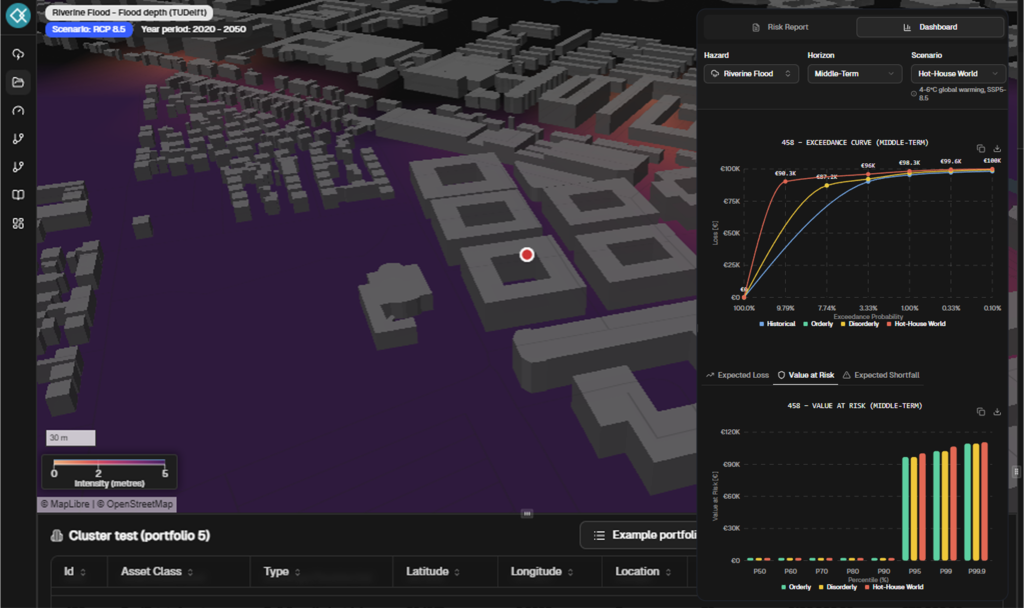

Alpha-Klima provides advanced tools for assessing physical climate risks to your business assets and operations. Our platform combines geospatial data, climate science, and risk modeling to help identify vulnerabilities and estimate potential financial impacts. We offer actionable insights that support strategic planning, regulatory compliance, and investment protection in the face of increasing climate volatility.

Alpha-Klima builds on physrisk, the open-source physical climate risk engine developed by OS-Climate, ensuring a fully transparent and auditable modeling framework. Our platform extends its capabilities through client-specific pipelines that transform physical exposure data into actionable climate risk metrics, aligned with regulatory frameworks such as CSRD or TCFD.

Technically, we leverage state-of-the-art tools from the Python ecosystem, including geospatial libraries like rioxarray, distributed computing with Dask, and advanced optimization and machine learning with Optuna. Our climate data inputs are drawn from the most recent peer-reviewed scientific literature, or, when not available, generated in-house by our data science team, which has developed pioneering methodologies for wildfire risk prediction.

What sets us apart is our rigorous approach to data and vulnerability modeling. Our damage functions are derived from academic research published in leading scientific journals, ensuring a scientifically grounded and replicable basis for assessing the physical impacts of climate change on assets and infrastructure.

Alpha-Klima provides comprehensive solutions to ensure your business complies with EU regulations like the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation (SFDR). Our platform enables businesses to disclose climate-related financial risks in alignment with EU standards, providing transparency and boosting investor confidence. We guide you through the regulatory landscape to ensure full compliance with all sustainability-related requirements.