Alpha-Klima connects best-available climate data, asset-level vulnerability models, and a financial risk engine to turn climate complexity into clear, auditable insight for portfolios and assets.

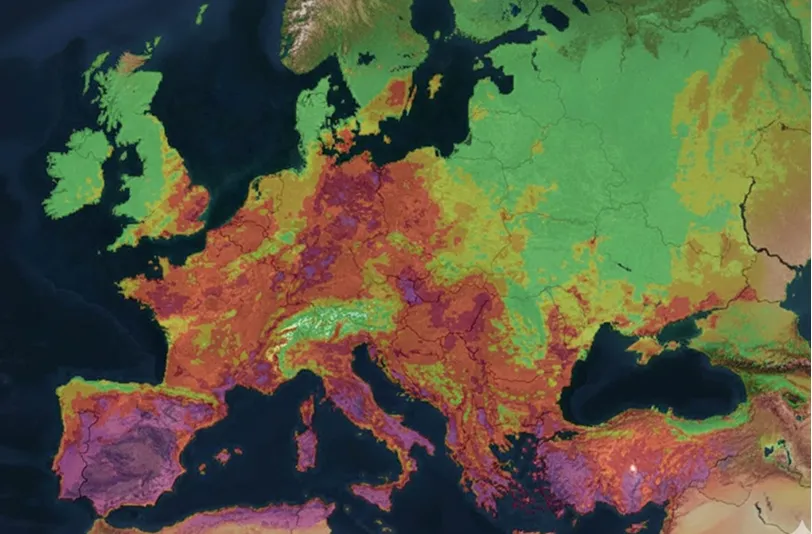

Identify where and how physical hazards — flood, heat, wind, wildfire, and drought — affect your assets and supply chain at asset level.

Translate physical damage and operational disruption into loss distributions and financial risk metrics such as VaR and Expected Shortfall across scenarios and time horizons.

Generate outputs aligned with regulatory and reporting frameworks, including CSRD and banking Pillar 3 requirements.

A complete workflow from climate data ingestion to financial risk outputs, designed for enterprise and regulatory use cases.

Asset-specific vulnerability models with configurable damage and loss functions based on downscaled projections and observed data.

Comparable financial metrics (VaR, ES) across scenarios and horizons to support risk management and strategic decisions.

Structured reports and exportable datasets for internal stakeholders, auditors, and regulators.

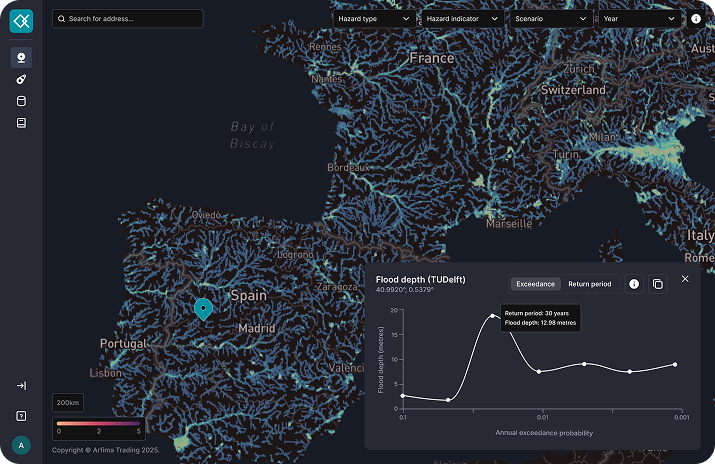

Curated hazard layers and downscaled climate projections define the intensity and frequency under multiple scenarios.

Assets, geographies, and supply-chain elements are mapped to hazard layers with full traceability.

Asset-specific vulnerability functions convert hazard intensity into physical damage and disruption estimates.

Damage and disruption are translated into loss distributions, portfolio metrics, and scenario-based financial risk outputs.

Latest GCM-based projections combined with satellite and observational datasets, supporting RCP/SSP pathways, time slices, regions, and versioned inputs for auditability.

Advanced modeling of asset damage and cash-flow interruption to quantify losses at both asset and portfolio level.

Interactive dashboards for exposure, impact, and financial risk, plus API access for seamless integration with BI, risk, and reporting systems. AI-assisted reporting available.