EU REGULATORY FRAMEWORK

QUANTITATIVE CLIMATE RISK ASSESMENT

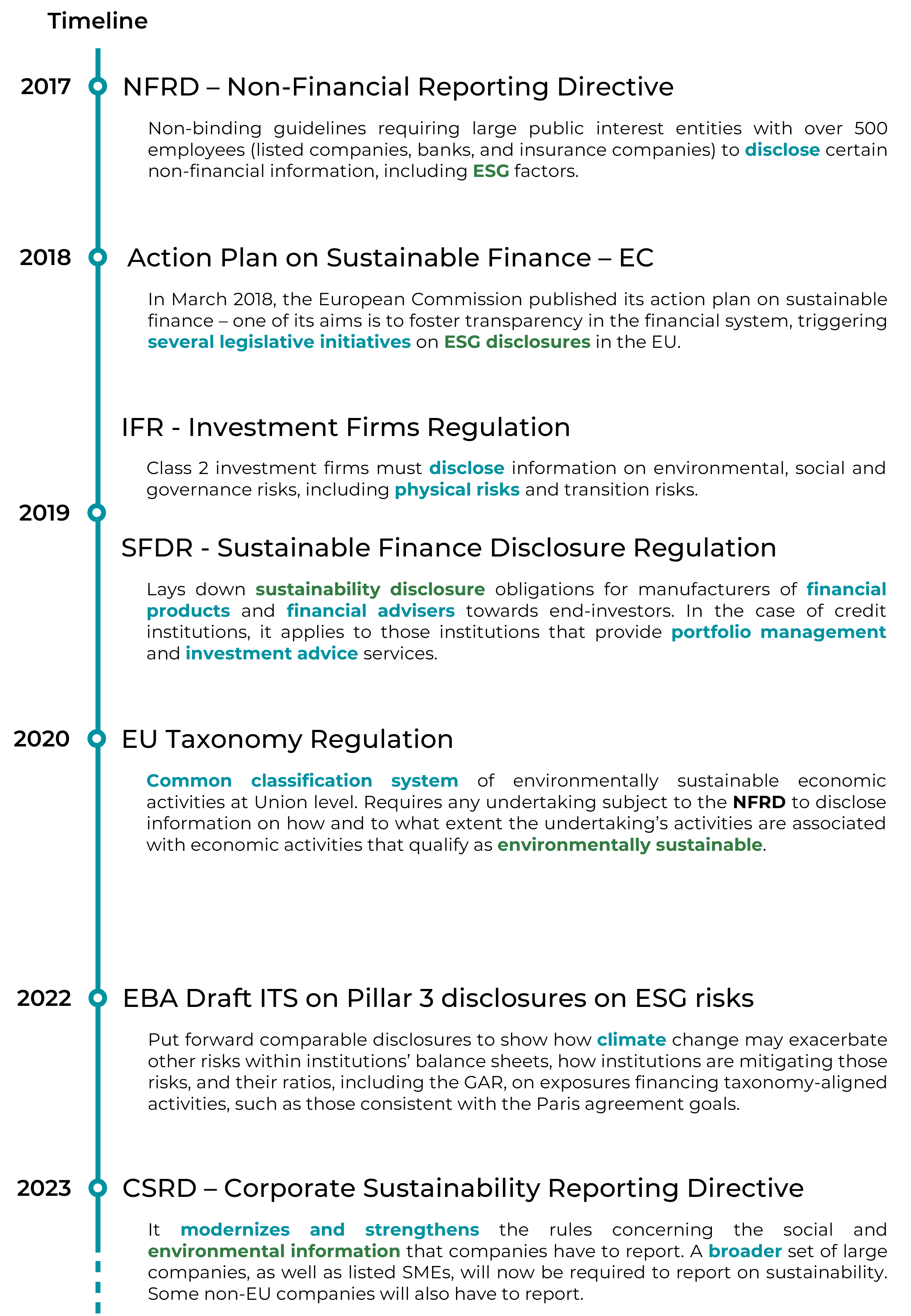

The European Union has recognized the critical need for robust climate risk assessment and effective adaptation strategies. In March 2018, the European Commission published an Action Plan to foster a sustainable financial system, with a strong emphasis on integrating Environmental, Social, and Governance (ESG) guidelines. The Plan aims to integrate sustainability into risk management and enhance transparency on sustainability-related issues, requiring new reporting obligations and data collection efforts. Strengthening resilience and reducing vulnerability to climate change are also key components of the European Climate Law and the EU Strategy on Adaptation to Climate Change.

Overarching Goals

Achieving the Paris Agreement goals in the EU by aligning regulations with climate targets.

Disclosing climate change risks to support mitigation and adaptation efforts.

Standardizing ESG reporting for consistency and comparability.

Promoting investment in sustainable businesses and sectors to drive long-term environmental benefits.

Preventing green-washing through stringent verification and transparency measures.

COMPLIANCE

Who is affected?

Most banks that are subject to the EU’s CRD IV/CRR. Including large EU institutions under the supervision of the ECB (see a complete list here), or those with securities traded on a regulated market of any EU member state.

“large” = any bank with assets exceeding €30 billion

What do they need to disclose?

- Quantitative Information on Climate Change Physical Risk:

- Institutions must disclose their exposures to sectors and geographies that may be negatively impacted by climate change events linked to physical risks, including acute risks (such as floods, storms, wildfires, etc.) and chronic risks (such as rising sea levels, prolonged droughts, etc.).

- Template 5 provides information on exposures in the banking book (including loans and advances, debt securities and equity instruments not held for trading and not held for sale) towards non-financial corporates, on loans collateralised with immovable property and on repossessed real estate collateral. These exposures are segregated by sector of economic activity (NACE classification) and geography (specifically for those materially exposed to acute and chronic events), and split into maturity buckets.

- Energy Performance and Real Estate:

- For real estate-related loans, institutions must disclose the energy performance of the underlying real estate collateral. This includes the distribution of real estate loans by Energy Performance Certificate (EPC) labels and energy consumption figures. These are disclosed to help understand how the properties backing loans could be impacted by physical risks, such as energy efficiency vulnerabilities.

- Mitigation Actions:

- Institutions are also required to disclose quantitative information on the actions taken to mitigate physical risks, including investment in taxonomy-aligned activities like climate change adaptation actions that mitigate physical risks (e.g. flood protection measures).

- Qualitative Information:

- In addition to quantitative disclosures, institutions must provide qualitative explanations regarding their risk management strategies, governance, and processes for identifying, monitoring, and managing physical risks.

- This includes the narrative accompanying Template 5 on the sources of information and methodologies that they have used when providing this information.

CSRD

Corporate Sustainability Reporting Directive

Who is affected?

- EU-based large undertakings, defined as meeting two of the following three criteria on consecutive balance sheet dates:

- total assets exceed €25 million;

- annual net turnover exceeds €50 million; or

- at least 250 employees on average throughout the year.

- EU-based parent of a group of entities that meet the above criteria as a whole.

- Small and medium sized enterprises (SMEs) with listed securities on any EU-regulated market meeting two of the following three criteria on consecutive balance sheet dates:

- total assets exceed €450k;

- annual net turnover exceeds €900k; or

- at least 10 employees on average throughout the year.

- Third-country undertakings (including the US) that generate more than €150 million in net turnover in the EU and meet at least one of the following criteria:

- owns a subsidiary under the definition of large undertaking in the EU;

- owns a subsidiary with listed securities on any EU-regulated market;

- owns a significant EU branch with net turnover exceeding €40 million.

Reporting Phase-in

| Entity Type | Fiscal Year | Starts Reporting in |

|---|---|---|

| Entities already subject to the NFRD (large listed companies, large banks and large insurance undertakings – all if they have more than 500 employees) | 2024 | 2025 |

| Large undertakings* not currently subject to the NFRD | 2025 | 2026 |

| SMEs with listed securities (excluding micro-undertakings*) | 2026 | 2027 |

| Third-country undertakings* | 2028 | 2029 |

*see left criteria

What do they need to disclose?

The European Sustainability Reporting Standards (ESRS) will be mandatory for use by companies that are obliged by the Accounting Directive to report certain sustainability information. By requiring the use of common standards, the Accounting Directive, as amended by the CSRD in 2022, aims to ensure that companies across the EU report comparable and reliable sustainability information. The ESRS take a “double materiality” perspective – that is to say, they oblige companies to report both on their impacts on people and the environment (impact materiality), and on how social and environmental issues create financial risks and opportunities for the company (financial materiality).

Out of the 12 topical ESRS proposed by EFRAG, the European Commission has decided that all the reporting requirements should be subject to materiality, with the exception of ESRS 2 on General Disclosures. This includes also ESRS E1 on Climate Change.

The methodology to assess materiality of physical climate risk exposure involves several key steps, focusing on double materiality:

- Impact Materiality

- A sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- or long-term.

- Assessment of Severity: This involves examining the scale, scope, and irremediable character of the impact:

- Scale: How grave the impact is.

- Scope: How widespread the impact is (e.g. the extent of environmental damage or number of people affected).

- Irremediable Character: The extent to which the impact can be mitigated or reversed.

- Financial Materiality

- A sustainability matter is material from a financial perspective if it triggers or could reasonably be expected to trigger material financial effects on the undertaking.

- Quantitative and Qualitative Analysis:

- Likelihood of occurrence and magnitude of potential financial effects, evaluated over short-, medium-, and long-term horizons.

- Examples include potential impacts on revenue from assets affected by extreme weather events or higher insurance costs due to increased risk exposure.

- Use of Scenario Analysis

- Companies should employ scenario analysis to understand potential future risks under various climate scenarios (e.g. IPCC or NGFS scenarios). This involves estimating the financial implications of physical risks on assets, operations, and the supply chain.

- Stakeholder Engagement and Sector Relevance

- Engage stakeholders and evaluate how physical risks align with sector-specific sensitivities, which may include dependencies on natural resources, geographic location, and exposure to climate-sensitive areas.

An example of a a physical climate risk materiality assessment is provided below.

Regardless of the materiality of their exposure, companies shall comply with the Disclosure Requirements related to ESRS 2 on General Disclosures:

- Disclosure Requirement related to ESRS 2 IRO-1 – Description of the processes to identify and assess material climate-related impacts, risks and opportunities:

- The undertaking shall describe the process to identify and assess climate-related impacts, risks and opportunities (IRO). This description shall include its process in relation to climate-related physical risks in own operations and along the value chain, in particular:

- the identification of climate-related hazards, considering at least high emission climate scenarios; and

- the assessment of how its assets and business activities might be exposed and are sensitive to these climate-related hazards, creating gross physical risks for the undertaking

- The undertaking shall explain how it has used climate-related scenario analysis, including a range of climate scenarios, to inform the identification and assessment of physical risks and opportunities over the short-, medium- and long-term.

- The undertaking shall describe the process to identify and assess climate-related impacts, risks and opportunities (IRO). This description shall include its process in relation to climate-related physical risks in own operations and along the value chain, in particular:

- Disclosure Requirement related to ESRS 2 SBM-3 – Material impacts, risks and opportunities and their interaction with strategy and business model:

- The undertaking shall explain for each material climate-related risk it has identified, whether the entity considers the risk to be a climate-related physical risk or transition risk.

- The undertaking shall describe the resilience of its strategy and business model in relation to climate change. This description shall include:

- the scope of the resilience analysis;

- how and when the resilience analysis has been conducted, including the use of climate scenario analysis as referenced in the Disclosure Requirement related to ESRS 2 IRO-1 and the related application requirement paragraphs; and

- the results of the resilience analysis including the results from the use of scenario analysis.

- More specifically, the objective of this Disclosure Requirement relates to:

- anticipated financial effects due to material physical risks, to provide an understanding of how these risks have (or could reasonably be expected to have) a material influence on the undertaking’s financial position, financial performance and cash flows, over the short-, medium- and long- term. The results of the scenario analysis used to conduct resilience analysis should inform this assessment;

- potential to pursue material climate-related opportunities, to enable an understanding of how the undertaking may financially benefit from material climate-related opportunities. This disclosure is complementary to the key performance indicators to be disclosed in accordance with Commission Delegated Regulation (EU) 2021/2178.

If furthermore climate physical risks are deemed material, they shall also comply with the requirements related to ESRS E1 outlined below:

- Disclosure Requirement ESRS E1-4 – Targets related to climate change mitigation and adaptation:

- The undertaking shall disclose the climate-related targets it has set. Including targets to manage material climate-related impacts, risks and opportunities, e.g. energy efficiency, climate change adaptation, or physical risk mitigation.

- Disclosure Requirement ESRS E1-9 – Anticipated financial effects from material physical risks and potential climate-related opportunities:

- The undertaking shall disclose its anticipated financial effects from material physical risks and potential to benefit from material climate-related opportunities.

- The disclosure of anticipated financial effects from material physical risks shall include:

- the monetary amount and proportion (percentage) of assets at material physical risk over the short-, medium- and long-term before considering climate change adaptation actions; with the monetary amounts of these assets disaggregated by acute and chronic physical risk*;

- the proportion of assets at material physical risk addressed by the climate change adaptation actions;

- the location of significant assets at material physical risk*; and

- the monetary amount and proportion (percentage) of net revenue from its business activities at material physical risk over the short-, medium- and long-term.

- The undertaking shall disclose reconciliations to the relevant line items or notes in the financial statements of the significant amounts of assets and net revenue at material physical risk.

- For the disclosure of the potential to pursue climate-related opportunities the undertaking shall consider**:

- its expected cost savings from climate change mitigation and adaptation actions; and

- the potential market size or expected changes to net revenue from adaptation solutions to which the undertaking has or may have access.

*This disclosure requirement is consistent with the requirements included in Commission Implementing Regulation (EU) 2022/2453 – Template 5: Banking book – Climate change physical risk: Exposures subject to physical risk (discussed above).

**A quantification of the financial effects that arise from opportunities is not required if such a disclosure does not meet the qualitative characteristics of useful information included under ESRS 1 Appendix B Qualitative characteristics of information.

Example of a Physical Climate Risk Materiality Assessment

Company Profile:

- Name: GreenBuild Corp

- Industry: Real Estate Development and Management.

- Geographic Scope: Assets located in coastal areas of Europe and Southeast Asia.

- Asset Types: High-rise office buildings, retail complexes, and residential properties.

Materiality Assessment Framework for Physical Climate Risk

| Step | Assessment Component | Description | Example Assessment |

|---|---|---|---|

| 1 | Identify Potential Physical Risks | Use data on extreme weather, climate projections, and asset locations to identify high-risk areas. | Coastal assets identified as vulnerable to sea-level rise and tropical storms. |

| 2 | Assess Impact Materiality | Evaluate if physical risks like flooding and hurricanes could significantly affect people or the environment (scale, scope, irremediable character). | – Scale: 20% of assets in high-impact zones – Scope: Impacts include potential displacement of tenants and major environmental repair costs. – Irremediable Character: High (assets in flood-prone areas may incur unrecoverable damages). |

| 3 | Assess Financial Materiality | Quantitatively model the potential financial impacts, including lost revenue, repair costs, and insurance premiums. Likelihood is based on climate data projections. | – Estimated repair costs for flooding: €10 million/year – Projected insurance premium increase: 15% over 5 years – Scenario Analysis (2°C warming): 10% reduction in asset value due to risk exposure. |

| 4 | Scenario Analysis | Test physical risk impacts under scenarios like 1.5°C, 2°C, or 4°C warming to capture long-term risk exposure. | Scenario findings show under 2°C, projected annual revenue at risk is €8 million. |

| 5 | Stakeholder Impact and Engagement | Identify stakeholders impacted by physical risks, including tenants, investors, and regulators. | High concern from tenants for asset reliability, requiring additional disclosures and potential adaptation investments. |

Conclusion

Based on the assessment, GreenBuild Corp determines that physical climate risks are material for their business due to:

- High asset exposure in vulnerable locations.

- Significant anticipated financial impacts on cash flow and asset valuation.

- Elevated stakeholder interest in risk mitigation and climate adaptation.

Disclosures

GreenBuild Corp would report:

- Quantitative Impacts: Projected costs for adaptation and repairs, expected loss in asset value, and increased insurance costs.

- Qualitative Insights: Strategies for resilience, scenario analysis findings, and engagement with stakeholders regarding adaptation efforts.

FAQs

Climate risk disclosures are crucial for transparency, investor confidence, and regulatory compliance. They report how companies manage climate risks and their financial impacts, enhancing sustainability and meeting evolving regulations.

Scenario analysis allows businesses to simulate the impact of future climate conditions under different emission pathways, aiding in decision-making and aligning strategies with climate goals. It helps assess risks and adapt operations for long-term resilience.

Physical climate risks can cause direct damage to assets, disrupt supply chains, and increase operational costs. Acute risks cause immediate disruptions, while chronic risks have long-term impacts on resources and infrastructure.

Climate risks are categorized into physical risks (e.g., floods, wildfires) and chronic risks (e.g., rising sea levels). Alpha-Klima focuses on quantifying these physical impacts and their financial consequences for businesses.