Alpha-Klima helps institutions navigate complex climate and sustainability regulations by translating regulatory requirements into structured, auditable, and decision-ready outputs aligned with leading frameworks.

Ensure consistency with key climate and sustainability regulations, including CSRD, EU Taxonomy, and banking supervisory expectations.

Simplify complex regulatory requirements by converting data, models, and scenarios into clear, standardized disclosures.

Reduce regulatory risk by delivering transparent, traceable outputs designed for supervisory review and external audits.

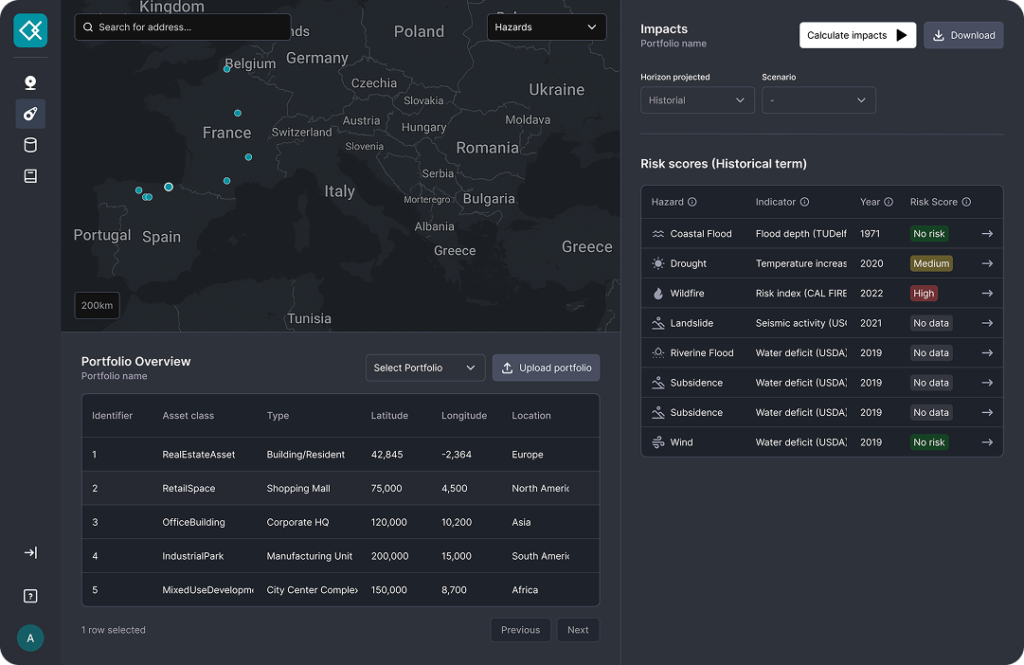

A structured approach that maps climate risk data and metrics directly to regulatory requirements and reporting standards.

Generate consistent, comparable disclosures aligned with regulatory templates and supervisory guidance.

Full transparency from data sources to final outputs, supporting internal controls and audit processes.

Bridge risk, finance, sustainability, and compliance teams with a single, coherent regulatory view.

Built to support evolving regulatory frameworks, translating climate risk analysis into compliant disclosures and supervisory-ready documentation.

Robust internal controls and validation processes ensure consistency, accuracy, and regulatory alignment across climate risk analyses and disclosures.

End-to-end traceability from source data to reported outputs enables efficient audits, supervisory review, and full methodological transparency.

Clear ownership, documented methodologies, and defined responsibilities support strong regulatory governance and accountability across teams.

Support double materiality assessments and climate-related disclosures with robust, data-driven evidence.

Enable climate risk reporting aligned with supervisory expectations and Pillar 3 disclosure requirements.

Strengthen internal processes with consistent methodologies, documentation, and validation-ready outputs.